Gold has held a special place in human history and culture for thousands of years. It has been used as a form of currency, a symbol of wealth and power, and a material for creating beautiful jewelry and art. One of the most common ways to measure gold is by the ounce. But what exactly is the value of an ounce of gold, and why does it fluctuate so much? In this article, we will explore the various factors that determine the value of an ounce of gold and its significance in the modern world.

Historical Significance of Gold

Gold has been prized by civilizations around the world since ancient times. The Egyptians were among the first to use gold for decorative purposes, creating elaborate jewelry and burial artifacts. Gold was also used as a form of currency in ancient Greece and Rome, where it was minted into coins. During the Middle Ages, gold became an important medium of exchange in Europe, and it played a crucial role in the development of international trade.

In the 19th century, the gold standard was established, which pegged the value of currencies to a fixed amount of gold. This system helped to stabilize the global economy and promote international trade, but it also had its limitations. The gold standard was eventually abandoned in the 20th century, as countries began to adopt fiat currencies that were not backed by gold.

Factors That Determine the Value of an Ounce of Gold

Despite the end of the gold standard, gold remains an important asset in the global economy. The value of an ounce of gold is determined by a variety of factors, including supply and demand, economic conditions, geopolitical events, and investor sentiment.

Supply and Demand

One of the most important factors that determine the value of an ounce of gold is supply and demand. Gold is a finite resource, and its production is limited by the availability of gold mines and the cost of extraction. When the demand for gold exceeds the supply, the price of gold tends to rise. Conversely, when the supply of gold exceeds the demand, the price of gold tends to fall.

The demand for gold comes from a variety of sources, including jewelry manufacturers, investors, and central banks. Jewelry accounts for the largest share of gold demand, followed by investment demand. Central banks also play an important role in the gold market, as they often buy and sell gold to manage their foreign exchange reserves.

Economic Conditions

Economic conditions also have a significant impact on the value of an ounce of gold. Gold is often seen as a safe-haven asset, which means that investors tend to buy gold during times of economic uncertainty or instability. For example, during a recession or a financial crisis, investors may sell their stocks and other risky assets and buy gold as a way to protect their wealth.

Inflation is another important economic factor that can affect the value of gold. When inflation is high, the value of paper money tends to decline, which makes gold more attractive as a store of value. In addition, rising interest rates can also have an impact on the gold market, as higher interest rates make it more expensive to hold gold.

Geopolitical Events

Geopolitical events can also have a significant impact on the value of an ounce of gold. Political instability, wars, and natural disasters can all create uncertainty and volatility in the global economy, which can lead to an increase in the demand for gold. For example, during the Iraq War in 2003, the price of gold rose sharply as investors sought a safe-haven asset.

In addition, geopolitical events can also affect the supply of gold. For example, political unrest in gold-producing countries can disrupt mining operations and reduce the supply of gold. This can lead to an increase in the price of gold.

Investor Sentiment

Investor sentiment is another important factor that can affect the value of an ounce of gold. When investors are optimistic about the economy and the stock market, they tend to buy stocks and other risky assets, which can lead to a decrease in the demand for gold.

Conversely, when investors are pessimistic about the economy and the stock market, they tend to buy gold as a way to protect their wealth.

In addition, investor sentiment can also be influenced by a variety of other factors, such as media coverage, market rumors, and government policies. For example, if the media reports that there is a growing risk of inflation or a financial crisis, investors may be more likely to buy gold.

The Role of Gold in the Modern Economy

Despite the end of the gold standard, gold remains an important asset in the global economy. Gold is used in a variety of industries, including jewelry, electronics, and dentistry. In addition, gold is also used as a store of value and a hedge against inflation and economic uncertainty.

Jewelry Industry

The jewelry industry is the largest consumer of gold, accounting for approximately half of the total demand for gold. Gold is prized for its beauty, durability, and rarity, and it is used to create a wide range of jewelry products, including rings, necklaces, bracelets, and earrings.

The demand for gold jewelry is influenced by a variety of factors, including fashion trends, cultural traditions, and economic conditions. For example, during times of economic prosperity, consumers may be more likely to buy gold jewelry as a luxury item. Conversely, during times of economic hardship, consumers may be more likely to sell their gold jewelry to raise cash.

Electronics Industry

The electronics industry is another important consumer of gold. Gold is used in a variety of electronic devices, including computers, smartphones, and tablets, because of its excellent electrical conductivity and resistance to corrosion. Gold is also used in the production of printed circuit boards, which are essential components of electronic devices.

The demand for gold in the electronics industry is influenced by a variety of factors, including the growth of the electronics market, the development of new technologies, and the availability of alternative materials. For example, as the demand for smartphones and other mobile devices continues to grow, the demand for gold in the electronics industry is also likely to increase.

Dentistry Industry

The dentistry industry is another important consumer of gold. Gold is used in a variety of dental applications, including crowns, bridges, and fillings, because of its biocompatibility, durability, and resistance to corrosion. Gold is also used in the production of dental implants, which are used to replace missing teeth.

The demand for gold in the dentistry industry is influenced by a variety of factors, including the growth of the dental market, the development of new dental technologies, and the availability of alternative materials. For example, as the demand for cosmetic dentistry continues to grow, the demand for gold in the dentistry industry is also likely to increase.

Investment Industry

The investment industry is another important consumer of gold. Gold is often seen as a safe-haven asset, which means that investors tend to buy gold during times of economic uncertainty or instability. Gold is also used as a hedge against inflation and currency fluctuations, as the value of gold tends to rise when the value of paper money falls.

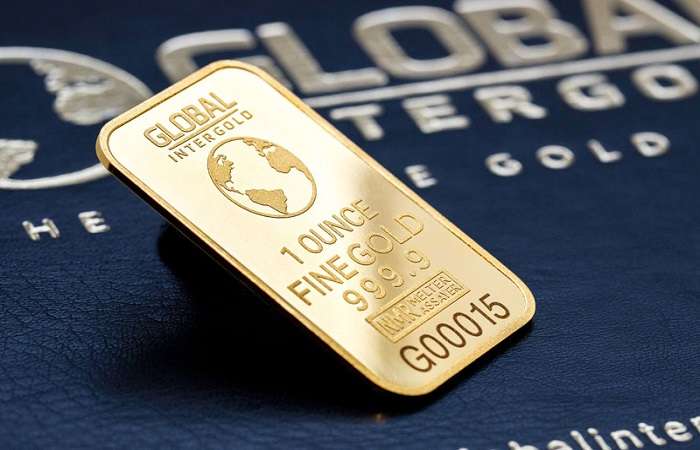

There are several ways to invest in gold, including buying physical gold, such as gold coins or bars, investing in gold exchange-traded funds (ETFs), or buying shares in gold mining companies. Each of these investment options has its own advantages and disadvantages, and investors should carefully consider their investment goals and risk tolerance before making a decision.

Conclusion

In conclusion, the value of an ounce of gold is determined by a variety of factors, including supply and demand, economic conditions, geopolitical events, and investor sentiment. Gold has held a special place in human history and culture for thousands of years, and it remains an important asset in the global economy today.

The demand for gold comes from a variety of sources, including jewelry manufacturers, investors, and central banks. Gold is used in a variety of industries, including jewelry, electronics, and dentistry, and it is also used as a store of value and a hedge against inflation and economic uncertainty.

Investors who are interested in investing in gold should carefully consider their investment goals and risk tolerance before making a decision. There are several ways to invest in gold, including buying physical gold, investing in gold ETFs, or buying shares in gold mining companies. Each of these investment options has its own advantages and disadvantages, and investors should do their research and consult with a financial advisor before making a decision.

Overall, the value of an ounce of gold is likely to continue to be influenced by a variety of factors in the future, and investors should stay informed about the latest developments in the gold market in order to make informed investment decisions. Whether you are a jewelry lover, an investor, or simply interested in learning more about the fascinating world of gold, understanding the value of an ounce of gold is an important part of understanding the global economy.

Related topics:

- Financial Experts Warn of Global Instability and Rising Demand for Gold

- Allio Finance Introduces Strategic Geopolitical Investing Approach Amid Global Market Uncertainty

- Stock Market Declines as S&P 500 Enters Correction Amid Economic Concerns