For centuries, gold has exerted an irresistible charm across the globe, and Singapore, the vibrant “Lion City,” is firmly under its spell. Its allure extends far beyond its glittering appearance. To some, it represents a steadfast investment, a reliable safeguard against economic uncertainties. For others, it’s a stunning centerpiece for jewelry, adding elegance and sophistication to any collection. And for many families, it’s a cherished heirloom, carrying memories and traditions from one generation to the next.The price of gold in Singapore is a subject that captivates investors, jewelers, and ordinary enthusiasts alike. In this in – depth exploration, we will peel back the layers of the current gold price landscape in Singapore. We’ll uncover the key factors that send prices soaring or cause them to dip, from global economic shifts to local demand trends. Moreover, we’ll provide practical tips on how you can stay on top of the latest price changes and make smart, well – informed choices when it comes to buying, selling, or investing in gold in Singapore.

Understanding Gold Purity and Its Significance

What is Gold Purity?

Gold purity is measured in carats (ct). Pure gold is 24 carats, which means it is 100% gold. However, pure gold is very soft and malleable, making it less suitable for everyday use, especially in jewelry that needs to withstand wear and tear. To make it more durable, gold is often alloyed with other metals like copper, silver, or zinc.

Common Gold Purities in Singapore

24ct Gold: As mentioned, this is the purest form of gold. It has a rich, deep yellow color and is highly valued for its purity. In Singapore, 24ct gold is often used in investment – grade gold bars and coins. For example, the Perth Mint’s 24ct gold bars are popular among investors in Singapore. However, due to its softness, it may not be the best choice for jewelry that will be worn frequently.

22ct Gold: This contains 22 parts of gold out of 24, which is 91.67% pure gold. The remaining 8.33% is made up of alloying metals. 22ct gold is a popular choice in Singapore for both jewelry and some investment items. It has a good balance between purity and durability. Many traditional gold jewelry pieces, such as the elaborate gold necklaces and bangles that are popular during festivals and weddings in the Singaporean – Indian and Singaporean – Chinese communities, are often made of 22ct gold.

18ct Gold: With 18 parts of gold out of 24 (75% pure gold), 18ct gold is also quite common. The additional alloying metals make it even more durable than 22ct gold. In Singapore, 18ct gold is often used in modern – style jewelry designs that require more intricate craftsmanship and need to hold gemstones securely. It comes in a variety of colors depending on the alloying metals used. For instance, if copper is the main alloying metal, it can give the gold a slightly rose – tinted color, which is trendy in contemporary jewelry.

Factors Influencing Gold Prices in Singapore

Global Economic Conditions

Inflation and Deflation: Inflation is a key factor. When the general price level in the global economy rises, the value of paper currencies decreases. Gold, being a store of value, becomes more attractive. For example, if the inflation rate in major economies like the United States, China, or the Eurozone increases, investors around the world, including those in Singapore, may turn to gold. In times of deflation, when prices are falling, gold can also be a safe haven as it retains its value better than some other assets.

Interest Rates: Central banks around the world, such as the US Federal Reserve, the European Central Bank, and the Bank of Japan, set interest rates. When interest rates are low, the opportunity cost of holding gold (which doesn’t earn interest like some other investments) decreases. This makes gold more appealing. Conversely, when interest rates rise, investors may be more inclined to put their money into interest – bearing assets, which can put downward pressure on gold prices. In Singapore, the Monetary Authority of Singapore’s (MAS) policies also have an impact. If the MAS tightens monetary policy, it can affect the local economic environment and, in turn, the demand for gold.

Exchange Rates: The Singapore dollar (SGD) exchange rate plays a role. Gold is often priced in US dollars globally. When the SGD weakens against the US dollar, it becomes more expensive for Singaporeans to buy gold. For example, if the SGD/USD exchange rate moves from 1.3 to 1.4, a gold bar that was previously priced at SGD 1,300 when the exchange rate was 1.3 (assuming the gold price in USD remains constant) will now cost SGD 1,400. This can influence both investment and jewelry – buying decisions in Singapore.

Geopolitical Tensions

Wars and Conflicts: Geopolitical tensions, such as wars, political unrest, and international disputes, can cause significant volatility in the gold market. When there are conflicts, like the ongoing tensions in the Middle East or political unrest in some African countries, investors become risk – averse. Gold is seen as a safe – haven asset, and its demand increases. In Singapore, investors may start buying more gold bars and coins as a hedge against global uncertainties.

Trade Wars: Trade disputes between major economies also impact gold prices. For example, the trade war between the United States and China in recent years led to increased market volatility. Singapore, being a major trading hub, was not immune to the effects. Uncertainty about trade policies and their impact on the global economy made gold more attractive to Singaporean investors, both institutional and individual.

Supply and Demand Dynamics

Mining Production: The global supply of gold comes mainly from mining. Major gold – mining countries include China, Australia, Russia, and South Africa. Any disruptions in mining production, such as labor strikes, natural disasters in mining areas, or changes in mining regulations, can affect the supply of gold. If the supply decreases while the demand remains stable or increases, the price of gold will rise. In Singapore, this global supply situation impacts the availability and price of gold in the local market.

Recycled Gold: Recycled gold, which is obtained from melting down old jewelry, electronics, and other gold – containing items, also contributes to the supply. In Singapore, there is a growing awareness of recycling, and many jewelry stores and gold dealers offer services to buy back old gold items. When more people recycle their gold, it can increase the supply in the local market, potentially putting downward pressure on prices.

Jewelry Demand: Jewelry is one of the biggest sources of gold demand globally, and Singapore is no different. The local population, with its diverse ethnic groups, has a strong tradition of wearing and gifting gold jewelry. Festivals like Deepavali, Chinese New Year, and Hari Raya are peak seasons for gold jewelry purchases. Additionally, weddings in Singapore often involve the exchange of gold jewelry. The demand for intricate and unique gold jewelry designs can drive up the price of gold in the local market.

Investment Demand: Singapore has a vibrant investment community. Gold is seen as a way to diversify investment portfolios. Exchange – traded funds (ETFs) backed by gold, gold bars, and coins are popular investment options. During times of economic uncertainty or when other investment markets are performing poorly, the demand for gold as an investment in Singapore can increase significantly.

How to Check the Current Gold Price in Singapore

Online Gold Price Platforms

There are several reliable online platforms that provide real – time gold price information in Singapore.

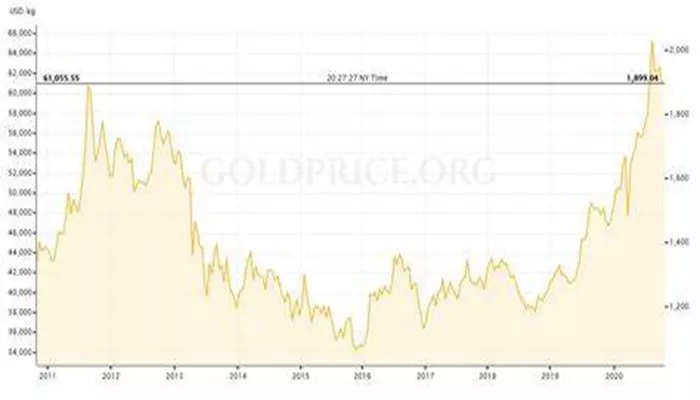

GoldPrice.org: This platform offers up – to – date prices of different purities of gold, including 22ct and 24ct. It aggregates data from various sources, such as international gold exchanges and local dealers. You can see the price of gold per gram or per ounce in Singapore dollars. It also provides historical price charts, which can be useful for analyzing price trends over time.

BullionStar: A well – known online bullion dealer in Singapore, BullionStar’s website not only offers gold products for sale but also displays the current gold prices in Singapore. They update the prices frequently to reflect the latest market conditions. The prices shown are for different forms of gold, such as bars and coins, and are available in SGD.

Local Gold Dealers and Jewelers

Visiting local gold dealers and jewelers is another straightforward way to find out the current gold price in Singapore.

In Orchard Road: Orchard Road is a major shopping district in Singapore. Here, you’ll find several high – end jewelry stores like Chow Tai Fook and Lee Hwa Jewellery. These stores display the prices of their gold jewelry, which is often based on the current market price of gold, plus a premium for design, craftsmanship, and branding. You can also ask the staff about the price of raw gold, such as gold bars, if they deal with such products.

In Little India and Chinatown: These ethnic enclaves in Singapore are known for their traditional gold jewelry stores. In Little India, stores offer a wide range of 22ct gold jewelry, and they can provide you with the current price of 22ct gold, both for jewelry and investment – grade products. Similarly, in Chinatown, you can find shops that deal with traditional Chinese – style gold jewelry and get information on gold prices.

Financial News Outlets

Local and international financial news outlets are great sources for gold price information.

The Business Times (Singapore): This local newspaper covers financial markets, including the gold market. It reports on the latest gold price movements in Singapore and around the world. Articles often analyze the factors driving the price changes, such as economic data releases, geopolitical events, or changes in central bank policies.

CNBC Asia: An international financial news channel, CNBC Asia, also covers gold market trends. Their reports are not only about the price but also about how different global events are impacting the gold market. This can help Singaporean investors and gold enthusiasts understand the broader context in which gold prices are changing.

Conclusion

In conclusion, the price of gold in Singapore is influenced by a complex web of global and local factors. Global economic conditions, geopolitical tensions, and supply – demand dynamics all play a role in determining the price of gold at any given time. Whether you’re looking to invest in gold, buy a beautiful piece of jewelry, or sell your existing gold items, it’s crucial to stay informed.By using online platforms, visiting local dealers, and following financial news, you can keep track of the current gold prices in Singapore. Understanding the differences in gold purity, the factors that affect prices, and the nuances of buying and selling gold will enable you to make more informed decisions.As the global economic and geopolitical landscapes continue to evolve, the gold market in Singapore will likely experience further fluctuations. However, with the right knowledge and approach, you can navigate this market with confidence and potentially benefit from the unique properties and value of gold. So, whether you’re a seasoned investor or a first – time gold buyer in Singapore, take the time to understand the market, and you’ll be better positioned to make the most of your gold – related endeavors.

Related topics:

- Is It a Good Time to Buy or Sell Gold?

- What is the Gold Rate in Singapore?

- The Price of 916 Gold in Singapore: A Comprehensive Guide